Daily Orders

“Then, there was neither non-existence nor existence.”

Building the MVP

While we continued to mature our Cloud Dairy ERP product, we started getting inquiries from clients who heard about the success of our mobile app rollout. Some of these companies already had an existing ERP solution (typically SAP or some home-grown system) but wanted a mobile app to manage their sales operations. Surprisingly, for a lot of large companies that spent hundreds of thousands of dollars on ERP rollouts, most of their critical operations (such as sales order bookings, etc) were still being carried out manually in spreadsheets. These thousands of orders would get accumulated at predefined cut-off times throughout the day and uploaded into their ERP to generate their sales invoices and delivery trip sheets. Since our mobile app was tightly coupled with our Sales and Distribution ERP module we could not offer the mobile app portion alone and they were not willing to swap out this entire module from their existing ERP.

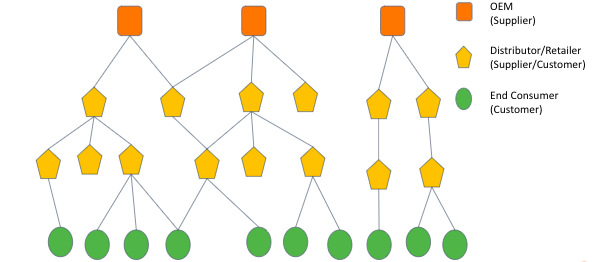

We did a further market analysis of the downstream sales chain and found that for pouch milk sales most dairy companies sold directly to retailers/agents (skipping distributors/stockists leg) and who in turn would sell and deliver to end-consumers daily. For milk products (cheese, ice creams, paneer, etc), the sales chain was similar to other FMCG companies and would be through distributors/stockists -> retailers -> end-consumer. Furthermore, in most markets, the distributors and retailers are aggregators who deal with multiple brands (OEMs). Majority of transactions (orders and payments) were manual across this distribution chain. OEMs had very little visibility into who their actual customers were (secondary and tertiary sales). Also, distributors and retailers had no tools to manage their customers and suppliers effectively. Huge collections burden severely impedes their ability to scale their operations.

We spent some time talking to all the various stakeholders across the distribution chain including OEMs, distributors, retailers/agents, and end-consumers. It became clear that the best way to empower a supply chain like this was to build a comprehensive B2B2C sales platform. It had to be a mobile-first solution with the following key characteristics:

- Handling complex multi Supplier-Customer relationships

- Handling a supply chain graph that includes thousands of Supplier nodes and tens of thousands of Customer nodes with independent as well as inter-related sub-trees

- Associating the platform user to a node with access to the associated product catalog and supplier/customer data

- An inviting model allowing a Supplier to onboard their customers to perform business transactions

- Ability to integrate with any backend system (either our ERP or any other 3rd party ERP)

We used the Sales & Distribution Module from our existing ERP product as the starting point to build out this independent sales platform. We tweaked the data model to make it a multi-tenant solution that can be used by Suppliers (tenants) to manage their entire sales operations including order management, payments, logistics, field force management, and asset management. A supplier can be an OEM, distributor, or retailer/agent who signs up with the platform to manage their sales operations. A supplier on-boards their set of customers who can be managed by the supplier’s sales staff and these customers can also be given direct access to the app (on an invite basis) to perform their business transactions including order booking, payments, track deliveries, etc.

The application has a shared data model and uses a shared database to host data for all suppliers. Key tables are partitioned on the basis of a unique ID assigned to each Supplier. Every user transaction on the platform is tagged with the appropriate Supplier ID. This allows the system to isolate the data Supplier-wise and ensures that there is no data leakage among tenants. Additionally, configurability built into the platform allows each Supplier to enable/disable various features as desired. A very flexible role-based permission framework allows a user to further access relevant screens and data (within the context of their associated Supplier) to which access has been granted.

Another key aspect of the platform is it provides the capability for large OEMs to track not only their primary customers (distributors) but also their secondary customers (retailers) and even tertiary customers (end-consumers) holistically within the same application. Most large OEMs use this solution to first digitize their primary leg and now we have started to see some of them expanding aggressively to digitize their secondary leg (retailers) transactions. A lot of these OEMs provide assets such as bottle coolers, freezers, etc to retailers to help them maintain their cold supply chain. A common sight in a lot of Kirana shops is to find a Company A freezer filled with products from Company B, C, etc! Since a lot of these OEMs don’t have visibility into these secondary sales, they end up spending thousands of rupees on each of these assets and yet are not sure about the ROI on this investment. Companies have started using our application to get these key insights and are able to attain higher ROIs on their assets.

Our initial name for this product during the launch was Suprabhat but some of our initial clients complained that their customers were getting confused since this name was already being used by a few smaller companies in the industry. Also, a few product names had Suprabhat as part of their brand name. So literally overnight we had to change to a more neutral name and so we went with Daily Orders. Our product was designed to work across industries and so a generic name served us well in terms of positioning.

Since we are catering to a wide spectrum of business models on this platform, our solution needs to provide the flexibility to allow these diverse types of models:

Order Model: Subscription (Daily, Alternate Days, Day of the Week, etc), Shopping Cart, B2B Simplified Order Entry, etc

Payment Model: Post Paid (with credit limit checks), Prepaid (Virtual Wallet), Order with Payment, etc

We went further and also provided a Supplier with the ability to mix and match these models within their customer base.

Additional complexity for large supply chains includes the ability to configure multiple ordering windows within a day (accordingly deliveries also can happen multiple times within a day) based on the geographical location of the customer (plant, sales office, route, etc) type of SKU. Also, hierarchical ordering windows need to be provided for customers and sales teams (SE, ASM, RSM, etc). Also, ordering UOM (unit of measure) could be different for the same SKU in different locations (e.g. a crate ordering UOM can have 24 packets in one location but 20 packets in another location). All these can easily be configured and managed by each Supplier on the platform.

The platform provides the ability for a Supplier to enable digital payments for their customers. Tracking collections is a very critical aspect for clients since most of them provide a one-day credit to their customers with strict payment cut-off times. The platform allows tracking of all modes of payment (including cash) in real-time. This allows sales managers to monitor credit limits and take informed supply decisions. A significant portion of the payments are still in cash within the Agri Supply Chain and so empowering cash collection agents to record cash transactions (with geo-tagging) in real-time has added significant transparency and eliminated a lot of related disputes among stakeholders. Our app has also facilitated a significant portion of hitherto cash transactions to move to digital modes of payment. From the beginning, this has been our endeavor and our app was one of the first non-banking apps to embed a native UPI SDK to enable UPI payments. We had to clear a rigorous RBI-mandated security audit of the mobile app before rolling out this feature.

After adding the core order management features on the platform we were getting requests from clients to digitize other aspects of their sales operations including field force management and delivery/vehicle management.

Some of the larger companies deploy hundreds of sales folks who are expected to be on the field pushing sales among their thousands of customers, signing up new customers, doing competitive analysis, etc. Monitoring and ensuring KPIs are achieved by the field staff is a huge challenge for these companies. Rather than doing this manually or relying on other solutions, our clients were pushing us to add these features in our app which was already being used by their sales teams. So we ended up adding a comprehensive field force automation sub-module to cater to these needs. Features like beat plans, live tracking, and productive calls tracking have been added on the same mobile app. Sales executives have detailed information (including complete ledgers) of all customers managed by them and can record field notes, capture images, track assets, etc while on the field. The application tracks attendance, time, distance traveled, orders booked, etc and all of this data can get integrated easily with TA billing systems. Managers can set and track sales targets for their team members and also track their location in real-time leading to more effective field deployments.

Another key area of focus of Daily Orders is the digitization of the logistics operations. We had witnessed first-hand the pain points of delivery operations which happen mostly in the night. Large companies have hundreds of delivery trucks that leave the factories late in the night and deliver the products to thousands of customers by early morning. Many of these customers may not even have a permanent establishment and goods get dropped off at curbside locations. On-time delivery is one of the most critical KPIs for dairy companies since any delay can lead to downstream deliveries (to households) getting impacted. After all, no one wants to face the wrath of a mother who is not able to provide a glass of fresh milk to her kid before leaving for school!

The life of these curb-side vendors has its own set of challenges since they need to be at the location in the wee hours of the morning waiting for the delivery of goods with little visibility to exact arrival times. A relatively small feature of live-tracking of the vehicle that we added to the mobile app was a game-changer for them and now they are able to more efficiently plan their downstream delivery activities. Furthermore, a real-time view into goods delivered, invoices, commissions earned, etc brings much-needed transparency to these key stakeholders.

Reverse logistics is another critical aspect of this supply chain and traditionally most companies struggle in keeping an accurate account of these items. Reverse logistics involves keeping track of return crates, product returns, and cash collection. Crates are important assets owned by these companies and our application helps in maintaining accurate ledgers of crates at the plant, transporter, and customer level.

One of our major digitization successes was helping one of the largest private dairies in India go completely paperless in managing all their sales processes. The distribution process traditionally involves printing thousands of sheets of paper daily usually using high-speed dot matrix printers. The truck driver carries physical copies of trip sheets, customer invoices, and other customer statements daily. We developed simple mobile screens where all this information is available at the fingertips in the mobile app for all relevant stakeholders including dispatchers, truck drivers, supervisors, and customers. Building the necessary features in the app in a user-friendly manner and focused push from the top management and business teams were critical success factors in this transition to paperless. It took several months of daily joint scrums with all key stakeholders to bring about such a massive change. Since all the key delivery operations happen throughout the night we had to provide 24 hours support in the initial phase and ensure that the application had zero downtime.

Even though Daily Orders caters to all Suppliers within the distribution chain, our initial focus was to onboard the OEMs (essentially the B2B leg). We also had good success in onboarding several D2C brands which were just cropping up in this segment. One of the first clients on this platform was a D2C brand that was just getting started. They were catering to about a thousand consumers and were struggling with order management and logistics since most of it was done in a manual fashion using spreadsheets. We digitized their operations and in a short time span of a couple of years helped them scale more than 10x with most of their customers relying entirely on the Daily Orders mobile app on a daily basis.

The B2C leg of this supply chain is a much harder nut to crack. It is highly unorganized and controlled by agents each of whom (along with their family members) handles 200–500 consumers located in housing colonies and apartment complexes. Onboarding these agents requires huge feet-on-street and a lot of handholding resulting in very high customer acquisition costs (CAC). These agents are also very wary about sharing their customer data. During this period a whole slew of subscription-based (milk and daily essentials) delivery apps mushroomed in the market and started catering exclusively to this B2C leg.

Some of them were very well-funded having convinced VCs about the giant total addressable market (100s of million!). They burnt all their capital trying to onboard agents (along with their customers) by offering them unsustainably high commission rates. The app company would then own the customers and be responsible for fulfilling their product subscriptions. It was clear to us from early on that with poor unit economics and no clear monetization strategy (except on spreadsheets projecting higher margins for the sale of white-label products in the future) these models were doomed to fail.

Apps like Doodhwala, Supr, Milkbasket, Daily Ninja, etc popped up like fireflies and some of these even raised tens of millions of dollars from VCs. Almost all of these have either folded or got acquired (firesale) by other large more well-funded companies only to die slow painful deaths there. This flurry of activity has left this whole segment even more confused. We have been fairly cautious about this segment and our focus was more on providing tools to tech-enable the existing agents rather than trying to disrupt their business model. We did onboard a few agents who came to us mainly by word of mouth. These agents have been very happy customers of the app since they were able to add further efficiency to their existing business processes, especially in the areas of customer billing and reconciled digital payments.

Scaling

Usage on the platform has seen exponential growth with requests served per day doubling every year. Currently, we’re serving more than one million requests per day with more than fifty thousand customer orders getting generated per day. Also, more than a million GPS points are getting tracked daily and more than forty thousand digital assets (images, PDFs, etc) are being ingested into this platform every day. To handle such high concurrency and high availability we had to redesign and optimize several areas of the application stack (across from the front end to the backend). In the process, we even had to break our monolithic backend and incorporate several serverless technologies so as to seamlessly handle the massive 24×7 scale of operations of our clients

We started with basic order management but over time Daily Orders has become a comprehensive solution for tracking every aspect of sales operations. It has been most gratifying for us to see this product powering not only some of the largest supply chains across the country but also providing the same technological tools to the smallest of suppliers (catering to only a few households) to manage their business. This is a true example of the democratization of technology. Undoubtedly a proud achievement for a small dedicated team that worked on this product from idea to scale and we feel like we’re just getting started on this journey!

For the original Medium.com article click Here

Milk Billing

Milk Billing Animal Health

Animal Health Artificial Insemination

Artificial Insemination BMCU Management

BMCU Management Tanker Receipt

Tanker Receipt Production Module

Production Module Stores and Purchases

Stores and Purchases Dairy Engineering

Dairy Engineering Field Asset Management

Field Asset Management HR

HR Accounting

Accounting B2B Order Management

B2B Order Management D2C Order Management

D2C Order Management Sales Logistics

Sales Logistics Field Force Automation

Field Force Automation Sales Heat Maps

Sales Heat Maps Crates Management

Crates Management Distributor/Dealer Management System

Distributor/Dealer Management System